I didn’t start thinking about banking until I turned 21.

To some, this statement may seem incredibly immature or irresponsible. To others, it may hit close to home. Truth is, my head was usually occupied by which concert would be my next or which fictional world I should spend the day wandering the pages of. I had no idea how loans worked or what having a bad credit score meant, and I sincerely didn’t care. I knew how to deposit and withdraw money in my checking account, and I had heard my parents talk about saving at some point or another, but I wasn’t actually paying attention. My experience in financial education was what you would call lacking. Isn’t that the problem with most of adult life? You need experience to be successful, but you’re not shown how to get it. My siblings unwittingly became my teachers. As the youngest of the four, I watched them make a lot of – I don’t want to say wrong, but – definitely not right decisions, which always left them broke and begging our mom to “borrow” money that would never be returned. So I typically did the exact opposite. Now it’s my turn to be the older sibling and share what I’ve learned, stumbles and all.

My first three jobs were all entry level jobs, all in the dreaded field of retail.

In order: I worked for a clothing store (that no longer exists), a combination bookstore/coffee shop (that no longer exists), and a chocolate shop (that still exists, proving that chocolate always prevails). I lived with my mom and stepdad while I worked these jobs, and all I was expected to pay toward was car insurance and the loan my parents took out for my car. There was no discussion as to how you get the loan or insurance. It was sort of just this is the way.

The control freak in me knew that was never going to last, but I appreciated everything they were doing for me, so I took their help and tried to make up for it by paying extra toward the car whenever I could and threw the rest of my paycheck in my savings account. I often felt like I was cheating at this part of the life game by accepting their help. Reflecting on it now, I’ve learned that taking someone’s hand when they’re reaching out to help you stand is very different from reaching out to drag them under.

Selling chocolate, as you can probably imagine in southern Arizona where humans melt in the summer, is more of a seasonal job.

The money is raked in around the holidays, but the demand starts to decline after Easter. This also means that the demand for chocolate slingers declines as well. When my hours got cut from around 40/week to 15-20/week, I started looking at alternatives and trying to figure out how to list “candy box stuffer” on a resume (I went with “consumable merchandise assembler”). After a couple months of having no idea what I was doing with my life and avoiding my parents because I was short $50 for my car payment, I jumped on every possible job search site and decided to take a wild chance on a job I knew essentially nothing about other than it was considered stable employment.

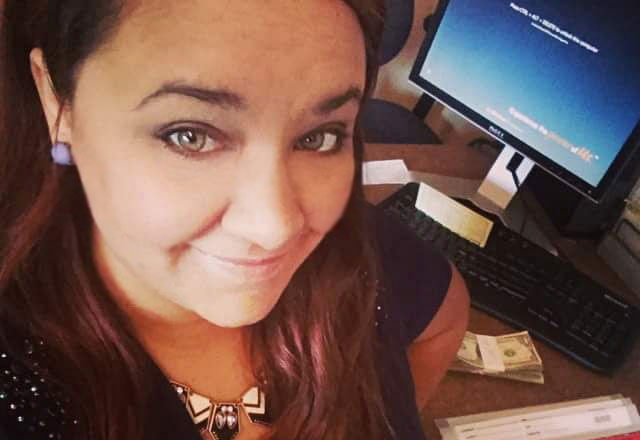

- Q: Can you guess which famous candy shop I worked for, pictured here in its originating state of San Francisco? The first reader to comment below with the correct answer wins $25!

The ad read CREDIT UNION LOOKING FOR TELLER, and I thought, “Perfect! …and what is that?”

I filled out the online application, attached my resume, googled how to teller, and then put in applications for 5 different retail stores because I never thought I’d actually get a call back from that credit union. A few days later I did. After three interviews, I found myself in a training class for two weeks and getting called into the office of the Training Director at the end to be told I was short of passing the final assessment by one question.

Hey, when I said I knew nothing about banking, I meant it. Luckily, the Director took pity on me and let me retake the assessment a day later. I spent the entire night reviewing our training materials, and I passed the test with only one question missed – something about the difference between secured loans and personal loans, as if I knew what either meant at the time.

That was my turning point.

I knew I had a lot to learn to avoid making a fool of myself once I was actually working with other people’s money, and I was terrified. Though, much like everything else in this life, we can only take things step-by-step. Houses aren’t built in one night, and my dear reader, neither are you. I was already 21-years-old but just starting to lay a financial foundation for myself that I could build on. Hopefully, I’ve caught you at a younger age to help push you ahead where I fell behind, but if not, that’s okay too. There’s nothing that says you have to go at someone else’s speed.

Maybe you’re in college and hadn’t even thought about thinking about how banking would play a role in the very near future. Maybe you’re like me and got a little lost in the woods and now want to find a smoother path. We have to set our own pace that works with where we are in our lives. For whatever stage you’re at, I hope this blog series helps you along your journey.

Open a Journey account at one of our SunWest branches, and we’ll help you build the bridge of better banking skills to avoid trudging through the muck.

May 20, 2021

Published by SunWest Credit Union

Go on, share this awesome article: